What Is Prime Cost In Managerial Accounting . The term prime costs refer to expenses directly related to the materials. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product. It is also known as 'flat cost,' 'first cost,' or 'direct. Indirect costs, such as utilities,. These costs are useful for. prime costs are used in calculating the cost of goods manufactured (cogm). a prime cost is the total direct costs of production, including raw materials and labor. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime costs are the costs directly incurred to create a product or service. what are prime costs in managerial accounting? Understanding prime costs is crucial for. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses.

from www.slideserve.com

prime costs are used in calculating the cost of goods manufactured (cogm). prime costs are the costs directly incurred to create a product or service. what are prime costs in managerial accounting? prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. Indirect costs, such as utilities,. Understanding prime costs is crucial for. a prime cost is the total direct costs of production, including raw materials and labor. These costs are useful for. It is also known as 'flat cost,' 'first cost,' or 'direct. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the.

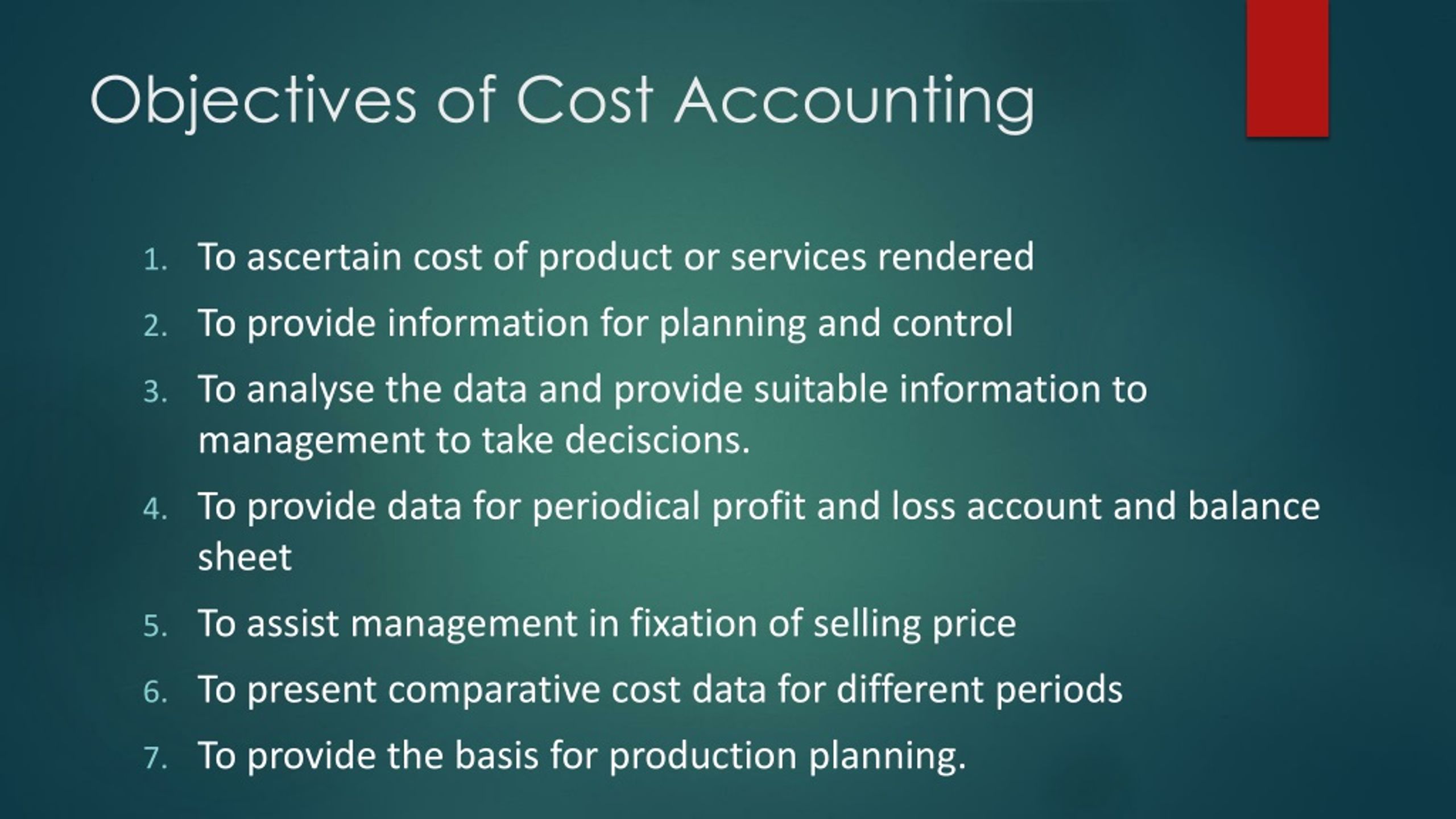

PPT INTRODUCTION TO COST ACCOUNTING PowerPoint Presentation, free download ID172128

What Is Prime Cost In Managerial Accounting Understanding prime costs is crucial for. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. It is also known as 'flat cost,' 'first cost,' or 'direct. prime costs are used in calculating the cost of goods manufactured (cogm). what are prime costs in managerial accounting? prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product. a prime cost is the total direct costs of production, including raw materials and labor. Indirect costs, such as utilities,. These costs are useful for. prime costs are the costs directly incurred to create a product or service. Understanding prime costs is crucial for. The term prime costs refer to expenses directly related to the materials.

From www.educba.com

Prime Cost Formula Calculator (Examples with Excel Template) What Is Prime Cost In Managerial Accounting Indirect costs, such as utilities,. what are prime costs in managerial accounting? prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime costs are the costs directly incurred to create a product or service. The term prime costs refer to expenses directly related. What Is Prime Cost In Managerial Accounting.

From present5.com

MANAGERIAL ACCOUNTING AND COST CONCEPTS Chapter 01 Power What Is Prime Cost In Managerial Accounting The term prime costs refer to expenses directly related to the materials. prime costs are used in calculating the cost of goods manufactured (cogm). prime costs are the costs directly incurred to create a product or service. Understanding prime costs is crucial for. a prime cost is the total direct costs of production, including raw materials and. What Is Prime Cost In Managerial Accounting.

From slideplayer.com

An Introduction to Managerial Accounting ppt download What Is Prime Cost In Managerial Accounting It is also known as 'flat cost,' 'first cost,' or 'direct. Indirect costs, such as utilities,. what are prime costs in managerial accounting? The term prime costs refer to expenses directly related to the materials. prime costs are used in calculating the cost of goods manufactured (cogm). prime cost is the aggregate of direct material cost, direct. What Is Prime Cost In Managerial Accounting.

From www.slideshare.net

Cost accounting ppt What Is Prime Cost In Managerial Accounting prime costs are used in calculating the cost of goods manufactured (cogm). It is also known as 'flat cost,' 'first cost,' or 'direct. Indirect costs, such as utilities,. The term prime costs refer to expenses directly related to the materials. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. prime costs. What Is Prime Cost In Managerial Accounting.

From www.slideserve.com

PPT Principles of Cost Accounting 13E PowerPoint Presentation, free download ID291129 What Is Prime Cost In Managerial Accounting Understanding prime costs is crucial for. It is also known as 'flat cost,' 'first cost,' or 'direct. prime costs are used in calculating the cost of goods manufactured (cogm). Indirect costs, such as utilities,. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. what are prime costs in managerial accounting? These. What Is Prime Cost In Managerial Accounting.

From www.iedunote.com

Cost Accounting Definition, Characteristics, Objectives, Cost Accounting Cycle What Is Prime Cost In Managerial Accounting Understanding prime costs is crucial for. prime costs are the costs directly incurred to create a product or service. It is also known as 'flat cost,' 'first cost,' or 'direct. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product. what are prime costs. What Is Prime Cost In Managerial Accounting.

From www.investopedia.com

Cost Accounting Definition and Types With Examples What Is Prime Cost In Managerial Accounting a prime cost is the total direct costs of production, including raw materials and labor. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. These costs are useful for. Understanding prime costs is crucial for. Indirect costs, such as utilities,. what are prime. What Is Prime Cost In Managerial Accounting.

From slideshare.net

Cost Accounting, Managerial Accounting, Financial Accounting What Is Prime Cost In Managerial Accounting prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. It is also known as 'flat cost,' 'first cost,' or 'direct. Indirect costs, such as utilities,. Understanding prime costs is crucial for. prime costs are used in calculating the cost of goods manufactured (cogm). The. What Is Prime Cost In Managerial Accounting.

From floridatechonline-2-staging.herokuapp.com

What is Cost Accounting? What Is Prime Cost In Managerial Accounting These costs are useful for. what are prime costs in managerial accounting? Indirect costs, such as utilities,. Understanding prime costs is crucial for. The term prime costs refer to expenses directly related to the materials. a prime cost is the total direct costs of production, including raw materials and labor. It is also known as 'flat cost,' 'first. What Is Prime Cost In Managerial Accounting.

From www.stockgro.club

What is Prime Cost? Definition, Formula & Calculation What Is Prime Cost In Managerial Accounting what are prime costs in managerial accounting? prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. a prime cost. What Is Prime Cost In Managerial Accounting.

From clockify.me

Cost accounting Principles, variants, and career guide What Is Prime Cost In Managerial Accounting prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. Indirect costs, such as utilities,. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. prime costs are used in calculating the cost of goods manufactured (cogm). Understanding prime. What Is Prime Cost In Managerial Accounting.

From www.vrogue.co

What Is Prime Cost Definition Formula Calculation And vrogue.co What Is Prime Cost In Managerial Accounting prime costs are used in calculating the cost of goods manufactured (cogm). It is also known as 'flat cost,' 'first cost,' or 'direct. prime costs are the costs directly incurred to create a product or service. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing. What Is Prime Cost In Managerial Accounting.

From www.youtube.com

Cost/Managerial accounting (CVP) lec 1(contribution margin per unit/ratio) YouTube What Is Prime Cost In Managerial Accounting prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. Understanding prime costs is crucial for. The term prime costs refer to expenses directly related to the materials. prime costs are the costs directly incurred to create a product or service. prime costs are. What Is Prime Cost In Managerial Accounting.

From alpha.wperp.com

The Ultimate Guide to Managerial Accounting (Part I) What Is Prime Cost In Managerial Accounting The term prime costs refer to expenses directly related to the materials. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product.. What Is Prime Cost In Managerial Accounting.

From woswandathomson.blogspot.com

what is management accounting Wanda Thomson What Is Prime Cost In Managerial Accounting The term prime costs refer to expenses directly related to the materials. These costs are useful for. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company. What Is Prime Cost In Managerial Accounting.

From www.jurnal.id

Prime Cost Pengertian, Faktor, Rumus, dan Contoh Perhitungan What Is Prime Cost In Managerial Accounting prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. prime cost (or flat cost or first cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product. a prime cost is the total direct costs of production, including. What Is Prime Cost In Managerial Accounting.

From www.youtube.com

Process costing flow of costs Managerial accounting YouTube What Is Prime Cost In Managerial Accounting Understanding prime costs is crucial for. prime cost is the aggregate of direct material cost, direct labor cost, and direct expenses. It is also known as 'flat cost,' 'first cost,' or 'direct. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. The term prime. What Is Prime Cost In Managerial Accounting.

From dxoppywbw.blob.core.windows.net

What Is The Cost And Management Accounting at Scott Mann blog What Is Prime Cost In Managerial Accounting a prime cost is the total direct costs of production, including raw materials and labor. prime costs are those costs that are directly incurred to create a product or a service and are particularly useful in determining the. The term prime costs refer to expenses directly related to the materials. Understanding prime costs is crucial for. Indirect costs,. What Is Prime Cost In Managerial Accounting.